Cepea, December 3, 2024 – US dollar quotations at around BRL 6 tend to boost prices of imported inputs, such as fertilizers, and, consequently, increase soybean production costs, especially second crops. On the other hand, it favors the revenue in Real (Brazilian currency) obtained for exported goods and boosts the export parity.

As a result, regarding the summer crop, which has consolidated costs, high dollar quotations favor sellers. Soybean prices were indeed sustained by the US dollar at high levels in late November, given that producers in Brazil are more optimistic with sales in 2025, despite the possible record crop.

The US dollar rose 3.9% against Real from October 31 to November 29, at BRL 6.006 on Nov. 29.

However, this scenario discouraged trades in the spot market and term contracts. On one hand, soy producers are focused on crop activities, being away from closing deals. On the other, most consumers claim to have stocks.

PRICES – The ESALQ/BM&FBovespa Index (Paranaguá) upped 1.21% in November (between Oct. 31 and Nov. 29, closing at BRL 145.64 per 60-kg bag on Nov. 29. The CEPEA/ESALQ Index (Paraná) downed 0.43% in the same comparison, to close at BRL 140.52 per 60-kg bag on Nov. 29.

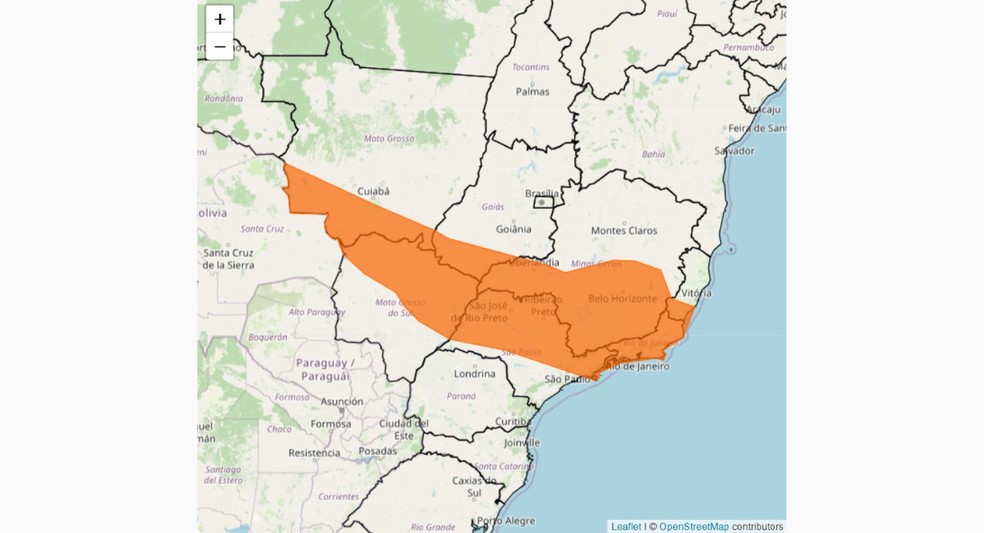

CROPS – Conab indicates that 83.3% of the area had been planted up to Nov. 24, higher than the 75% verified one year ago.

(Cepea-Brazil)

Centro de Estudos Avançados em Economia Aplicada – CEPEA-Esalq/USP